All You Should Know About Business Setup in Dubai and Company Setup in UAE

A business setup in Dubai can be a lucrative opportunity to expand the company's reach internationally and establish a reputable brand name. Whether you're a small, medium, or large business, you can take advantage of Dubai's cutting-edge infrastructure, strategic location, easy access to nearby markets, superior connectivity that makes it out of the world. This is why in the Middle East, the formation of business in Dubai is trending.

In fact, Dubai's Department of Economic Development (DED) reports a 13% year-on-year increase in new startups looking to do business in the city-state. Dubai's expanding economy offers numerous opportunities. Profits are being returned in the services, finance, trade, real estate, & properties sectors. In addition, it is one of the most cosmopolitan cities in the Middle East.

Why Company Formation in Dubai?

There 3 top reasons behind setting up your business in Dubai:

- The corporate tax, withholding tax, VAT, import-export tax, and capital gains tax does not apply to companies incorporated in Dubai.

- The UAE has signed more than 66 international double tax treaties with major countries such as China, the United States, and the majority of EU members.

- Foreigners can easily obtain local currency because there are no exchange controls in place.

Investors from all over the world make up Dubai's population. As a result, the city is always up to date on the latest trends and developments. It is also a foodie's paradise for those who want to try new cuisines. Dubai is also a shopping paradise because the city does not levy VAT. Residents and businessmen planning to start new ventures in Dubai are exempt from paying personal income tax.

Top 5 Reasons To Set Up Business In Dubai

Here are the top 5 reasons for company setup in Dubai.

1. The Booming Economy

The first and foremost reason to establish a business in Dubai is the country's rapid economic growth. Dubai is the world's fifth fastest-growing city, according to the 2014 Metro Global Report. Dubai has come a long way in establishing itself as the prosperous and hardworking business center that it is today. Companies from all over the world are relocating to the UAE and establishing offshore subsidiaries.

Today the UAE is home to many start-ups and multi-million dollar conglomerates.

2. Availability of Skilled Workforce

Finding the right people to work with is one of the most difficult aspects of starting a business in Dubai. Dubai's liberal and cost-effective labor laws, combined with the city's desirable working environment, make it simple and affordable to hire employees from almost anywhere in the world. The ease with which expatriate workers, who account for an astounding 90% of the city's labor force, can enter and exit the UAE. It makes it easier for businesses to scale their resources up and down as needed.

3. Location, Infrastructure, and Reputation

With no stone unturned in its efforts to welcome foreign investors, the UAE government provides world-class infrastructure that you can leverage for your own business in Dubai. There is rarely anything you will miss out on for your business in Dubai, whether it is transportation, healthcare facilities, education, business parks, corporate spaces, or others. Dubai's location, infrastructure, and business reputation – the crown jewel of the Emirates – make it not only an ideal place to start a business in Dubai but also a remarkably easy place to attract business.

4. Businessmen Friendly Laws

The UAE government provides numerous opportunities for foreign investors to conduct business in Dubai. Various pieces of legislation are put in place in the market to create a welcoming environment for businesses of all sizes and budgets.

Because foreign investments are so important to Dubai's economy, the government is constantly changing the laws to make them more favorable to foreign investors. Furthermore, documentation and legal procedures are expedited to ensure smooth licensing, registration, and other processes.

5. Tax Exemption

One of the major hassles of opening a business in a foreign territory is developing an understanding of their tax laws and maneuvering your business so that you have minimum taxes to manage. The Emirates offers various kinds of business ownership patterns and tax categories. One among them stands out to be the Free Zones with the feature of 100% tax exemptions. There is 0% corporate and income tax, 30 % tax rebate on international film and TV production spending. This means that the owner does not have to pay any taxes to the government.

Learn more about the advantages that attract people to start a business in Dubai

Advantages of Business Formation in Dubai

Dubai, one of the seven emirates of the United Arab Emirates, is one of the most populous cities and a global business hub. The numerous advantages of establishing a company in Dubai have made it very appealing to foreign trade and investment. The Dubai government has opened the doors to various types of business setups from all over the world. They were confident that allowing foreign trade would benefit both parties.

The Dubai government was correct, and now both the city and foreign investors benefit from the many advantages of establishing a business in Dubai. Dubai is now a financially powerful city, and you can consider establishing a business there. To help you understand better, let's look at a few prominent benefits of starting a business in Dubai.

- Ease of Starting a Business.

- Recruit Expatriate Workers.

- There is no taxation.

- There are more than 20 free zones.

- Technological Progress.

- Geographically advantageous location.

- Infrastructure that is second-to-none.

- Comfortable and high-quality way of life.

- Easy visa access.

- Government Support.

Strategic Location for Company formation in Dubai

Formation of a Freezone Company In Dubai, a highly profitable venture that provides various business opportunities and networks in the emirate. The Free Zone, also known as the Free Trade Zone, is intended to boost international businesses by providing émigrés with 100 percent ownership.

Free Zones are geographical areas within a country where goods, services, and commodities can be traded without violating strict customs regulations. The main reason for establishing Free Zones in the UAE was that international business centers for companies doing business outside the UAE were not accredited to operate within the UAE.

Freezone Company Formation Services In Dubai offer shareholders and business start-ups important incentives for establishing their office in the free zones. Here are some of the most remarkable of them.

- 100% ownership without the help of UAE sponsor.

- Freedom from personal income tax and capital gain tax.

- Complete repatriation of capital and revenues from the business.

- Nominal Import and Export duty.

- Zero percent corporate tax.

- No limit on currency movements.

- Single window clearances for managerial services.

Mainland company formation in Dubai can be a very lucrative investment option for investors and business establishments. Mainland companies are business entities that are permitted to operate and function within the boundaries of Emirati jurisdiction that fall within commercialized geographical regions. In Dubai, all commercial, professional, and sole establishments registered with the Dubai Economic Department (DED) are referred to as Dubai Mainland License. First and foremost, having a Dubai mainland license gives you the most freedom and flexibility in growing and operating your business. The government amends certain regulations and policies that govern the operation of mainland companies in the UAE.

The Government of the UAE's implementation of reforms to the Commercial Companies Law, which will take effect in June 2021, will transform the future of business. For businesses located on the mainland, the UAE government has permitted 100 percent foreign ownership. Previously, ex-pat business owners could only own a maximum of 49 percent of their company, with the remaining 51 percent owned by the Emirati sponsor Foreigners establishing a company in Dubai will no longer require an Emirati shareholder or agent, thanks to changes in UAE company law.

Mainland company formation in Dubai, UAE gives you the freedom to extend your business’ branches to other parts of Dubai and across the UAE. The primary requirement for all business activities in the UAE is to own a license in any of the categories: Commercial, industrial and Professional.

How to Set Up a Business in Dubai?

Over the last few decades, the UAE has successfully emerged as a global investment and tourism hub, and it is unquestionably any businessman's dream to establish a presence here. It is one of the best places in the world to grow your business because it provides numerous opportunities to foreign investors, businesses, and entrepreneurs. Prior to forming a company in the UAE, you should have a thorough understanding of the UAE market as well as an understanding of the initial costs of doing business in the UAE.

If you are unfamiliar with the legal requirements, forming a company in the UAE can be a nightmare for you. It requires approvals from various government departments, and a single error will result in the form being resubmitted, as well as financial loss.

The United Arab Emirates offers 3 types of company formations, which are mainly Free Zone Business Setup, Business setup in UAE mainland, and Offshore Company Setup UAE. The rules and procedures for setting up a firm are different for all these establishments.

Licensing in Dubai for Business setup

The UAE government's new company laws, flexible regulatory procedures, short timelines, and simple approval processes have made the Mainland License a popular choice among the region's start-ups and investors. According to the new FDI laws, there is no longer a requirement for a local sponsor to launch a company, implying that ex-pats can now own 100 percent of an onshore company.

It is not necessary to have a physical office space in order to register a company in Dubai, and Creative Zone's co-working DED package would be an excellent starting point. With a DED license, you can easily work with government entities and conduct business throughout the UAE. In exchange for proper documentation, the UAE grants licenses to those who want to start a new business, and these licenses grant authority to run businesses in various zones.

For a Business license in Dubai, the following documents have to be provided:

- A copy of the Feasibility Study is required.

- An Existing Company Profile is needed.

- Information related to the Investor is needed.

- A copy that is attested related to the Certificate of Incorporation, MOA, and AOA is required.

- A Board Resolution of the Company is mandatory.

- At least three months of bank statements related to the parent company are required.

- A Passport Copy and Original Power of Attorney are needed.

After the Department of Economic Development (DED) has approved your business name and activity, you can apply for a trade license and begin the process of registering a company in the UAE.

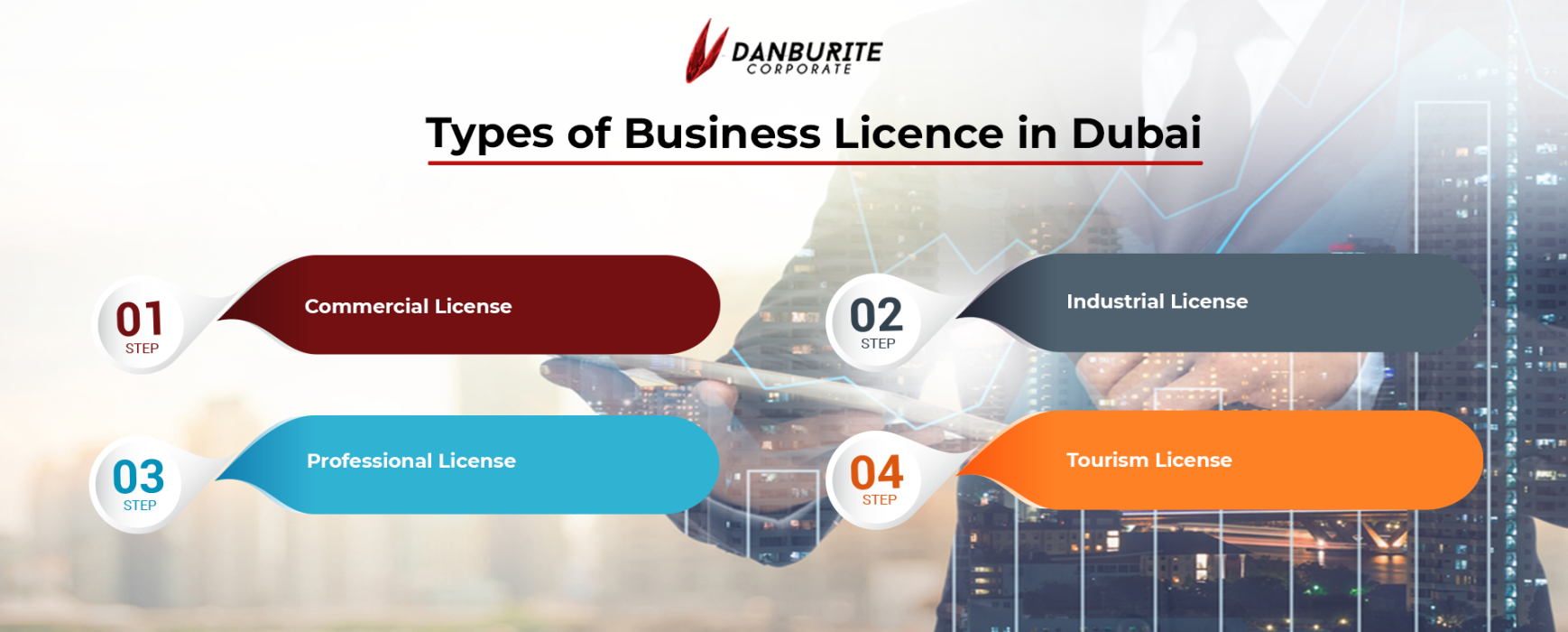

There are 4 types of license in Dubai:

- Commercial license.

- Industrial license.

- Professional license.

- Tourism license.

If you want to start a business in the UAE, you can choose any of the four licenses listed above. The licensing structures for UAE Free Zones differ from those described above and are determined by the type of business activity you intend to conduct.

DED will ask you to obtain necessary approvals from various government or non-government agencies at the same time. The documentation and approval stages differ depending on the type of business and activity.

Process of Company Registration in Dubai

If you are thinking of setting up your company in Dubai then you need to know about registering a business in Dubai.

Here are the steps involved in registering a company:

1. Choosing the Business Activity

The first step in obtaining a free zone is determining the type of business you will conduct. It also depends on the type of license you applied for; based on that, you will be able to carry out the activities you desire, such as professional services, commercial and trading, and so on. Dubai has specific requirements based on the type of license you have and the activities you wish to engage in. For a simple and smooth start, it is best to work with a company formation specialist.

2. Finding a Free Zone

Once you've determined which business activity is best for you, the next step is to determine which free zone is best for you. Actually, there are a number of factors to consider before making this choice. Begin by deciding whether you want to establish yourself in a sector-specific free zone. Some of the industries served by Dubai's industry-specific free zones include healthcare, ICT, production, design, outsourcing, media, maritime, science, and finance. Alternatively, there are numerous larger free zone options.

3. Choosing a Company Name

Now the most difficult part is choosing the name of the company. While choosing your UAE company name there are certain things that should be kept in mind- the first thing is to make sure your business name is available to be registered. The name should not contain blasphemous language or anything related to religious or political organizations. If you decide to keep the name of the company in the name of any person then it has to be a partner and shareholder in your business, only full name is allowed rather than initials or abbreviations.

4. Make your license Application

Now that you've decided on a company name, what type of business you'll run, and where you'll set up shop, it's time to make Dubai free zone company formation official by submitting your application. The specific documents required for Dubai free zone company formation will vary depending on the type of license you are applying for and the free zone you have chosen. As a general rule, you can anticipate being asked for some or all of the following:

- Color copy of the shareholder(s) passport and visa if applicable.

- Application form.

- Business plan.

- Board resolution.

- Memorandum and articles of association.

5. Applying for Visa

At this point, you can apply for a visa yourself as well as for your employees and staff. The process is the same whether you are applying for your own visa or sponsoring someone else's: entry permit, status adjustment, medical fitness test, Emirates ID registration, and visa stamping. Once again, a company formation specialist can help you with this.

Also, read about Free Zone Visa in Dubai.

6. Opening a Bank Account for Company Formation in Dubai

A bank account is required to operate a business. Opening a corporate bank account in the UAE is not always simple, and there are several factors to consider, not the least of which is each bank's eligibility criteria.

Cost of starting Business in Dubai

High startup costs endanger fledgling UAE-based startups and discourage many would-be entrepreneurs from launching businesses in the country. While there are numerous advantages to doing business in the UAE, such as zero income tax, world-class broadband, and a multilingual workforce, these advantages are meaningless if a prospective company cannot afford to get started.

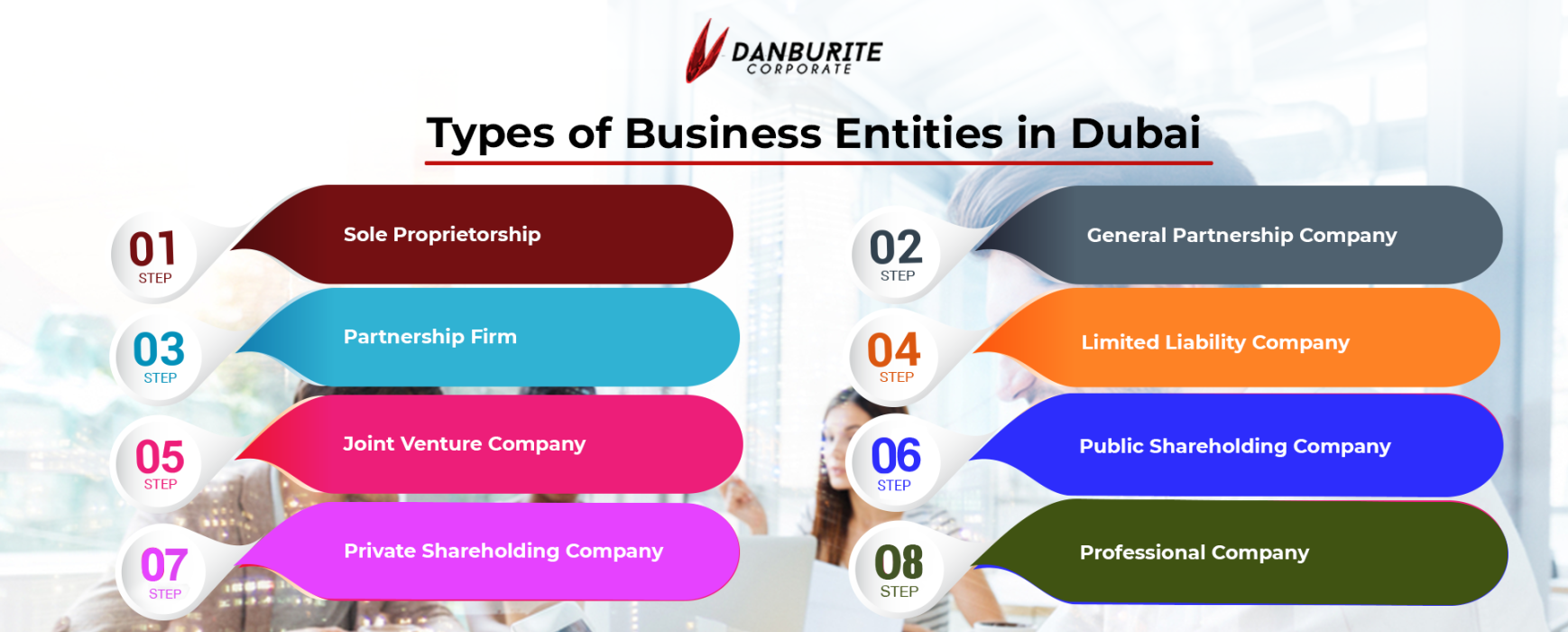

Types of Business Entities in Dubai

As per the Federal Law, an ad company in Dubai must haven't but 51% local equity (participation of UAE nationals). There are seven business categories of organizations that are allowed to register a company in Dubai. These are explained below one by one.

1. Sole Proprietorship

Sole Proprietor Company in Dubai could also be a separate lacerated by one individual. A sole proprietor is in complete control of the company's operations and completely bears the profits and losses. A sole proprietor is fully liable for the company's debts or obligations. A sole trader from Dubai may carry out commercial or technical activities throughout the Emirates.

Also, read How to start Sole Proprietorship Company in Dubai?

2. General Partnership Company

A General Partnership Company in Dubai is owned by two partners who bear unlimited liability, and are responsible for the debts and obligations of the company during a private capacity. A general partnership may dissolve in the event of bankruptcy, withdrawal, insanity, or death of a partner.

Also, read the Process to start a General Partnership Company in Dubai.

3. Partnership Firm

A partnership in Dubai is made up of one or more general partners who are personally liable for the company's profits, losses, debts, and obligations. Because of the financial commitments involved in a limited partnership, the joint partners in Dubai require UAE nationals.

Also, read How to set up a Limited Partnership Company in Dubai?

4. Limited Liability Company

An indebtedness Company or limited liability company (LLC) is one whose liability is limited to the extent of their shareholding within the corporation. An LLC may engage in any type of business activity except insurance, banking, and money investment. Trading LLCs are allowed to conduct business in their local Emirate as well as easily export and import.

Also, read Ultimate Guide to Start a Limited Liability Company(LLC) in Dubai.

5. Joint Venture Company

In Dubai, a joint venture company could also be a contractual agreement between a global party and a regional party authorized to conduct the desired business activity. An exclusive license is not granted in the company's name. The primary partner's license is sufficient for project implementation with the assistance of the other partner who is involved in the company's operations.

Also, read How to start a Joint Venture Company in Dubai?

6 Public Shareholding Company

A Public Shareholding Company in Dubai is additionally called a Public Joint Stock Company. it is the one where the business capital is split into equal shares, with each shareholder's liability limited to the number of shares within the corporate. The founder members may only hold 35% of the share capital, with the remainder required to be offered to the public. In this business, the capital is divided into equal shares among the shareholders, and their respective number of shares limits each shareholder's liability.

Also, read Procedure for starting a Public Shareholding Company in Dubai?

7 Private Shareholding Company

In Dubai, a Private Shareholding Company, also known as a Private Joint Stock Company, is owned by a non-governmental organization. AED 2 million is the minimum capital required to register a private shareholding company in Dubai. The Chairman and majority of the Directors in a private shareholding company must be UAE nationals.

Also, read How to start a Private Shareholding Company in Dubai Free Zone?

8 Professional Company

A Professional Company in Dubai could be a corporation that runs on the intellectual efforts of its partners. The UAE has explicit norms that govern the behavior of professional firms. To start a knowledgeable company, one must have a knowledgeable license.

Also, read What are the documents I need to obtain a professional license in the UAE?

Moreover, 51% participation of UAE nationals is the overall norm within the seven companies mentioned above types, aside from the next scenarios:

Where 100% of local ownership is required trade Zones, where 100% foreign ownership is allowed in activities with 100% Arabian Gulf Cooperation Council (AGCC) ownership, where wholly owned AGCC companies partner with UAE nationals were foreign companies register a representative office or branch in Dubai artisan or professional companies, where 100% foreign ownership is allowed.

As per United Arab Emirates Cabinet Resolution No. 16 of 2020, it has been resolved that hundred percent (100%) ownership for foreign investors are now allowed for some classes of business.

Top 10 Booming Industries in Dubai That Have a Positive Future in Dubai 2022

The United Arab Emirates has the largest economy in the Middle East, with a GDP of $421 billion USD (as of 2020) Because petroleum is a major source of revenue in the UAE. The country has been attempting to diversify its economy for some time. Oil exports account for up to 85 percent of the UAE's economy. In terms of its ability to attract foreign direct investment, the UAE was ranked 27th globally in 2018 (up to three positions from 2017). (FDI). The UAE has been investing in order to diversify its market.

Recently Dubai has become the first Government in the world to go one hundred percent digital. Therefore, Business opportunities in Dubai are available not only to UAE citizens but also to foreign investors. Indeed, foreign investors are enticed to come to Dubai because a foreign business boosts the Dubai economy significantly.

The top 10 booming enterprises in Dubai are:

Below is the list of the top 10 new Business Ideas in Dubai 2022 which are in demand.

- IT Solutions

- Tour and Travel Services

- Job Consultancy

- Digital Marketing Agency

- Manufacturing

- Transportation Business

- Logistics Management

- Constructions

- Health Care

- Real Estate

As explained before, it is important to choose a business of your choice for setting up business in Dubai. These ten are just the top of the barrel of opportunities. To reach the bottom of this barrel, also, read about 50 business opportunities in Dubai.

Take Help From Us to Setup Business in Dubai

Are you planning to start your business in Dubai? If so, prepare your business idea and contact Danburite Corporate, an international business consultant in Dubai who has guided thousands of business owners to a successful business setup in Dubai. You can be confident that your business setup is in good hands.